What is Covariance? Covariance is simply the variance between the observations of two random variables. It should be clear both…

Following up on Part I, we’re going to kill two birds with one stone and learn both how to simulate…

In parallel to our ongoing series introducing different Monte Carlo techniques I thought it would be fun to incorporate more…

If you haven’t read the first two posts introducing the concept of Monte Carlo simulations and running through a basic,…

For a quick overview of Monte Carlo simulations, I recommend you check out Part I. Example: Suppose we work for…

The two most common measures applied to proposed projects (for everything from expansion to replacing old equipment) are net present…

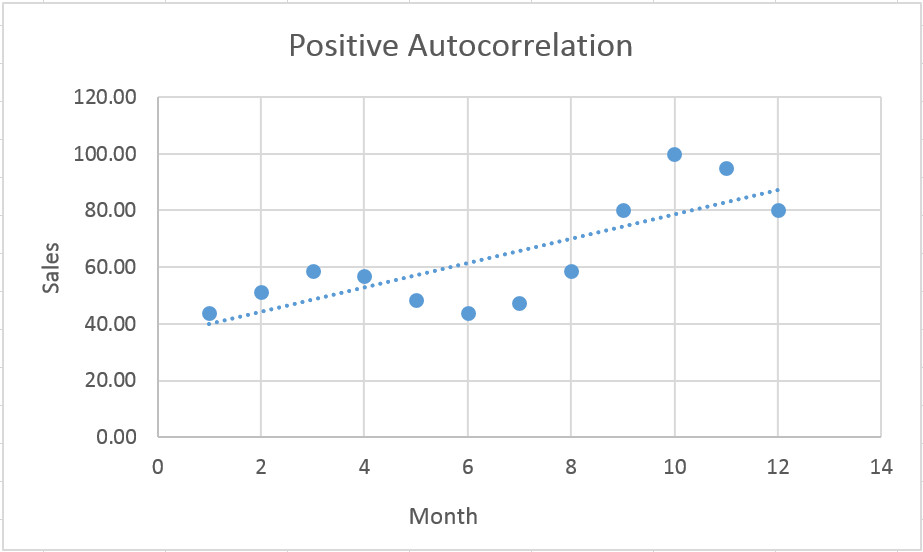

ARIMA models require some study and application to thoroughly understand. The rewards are well worth it though, if you master…

VaR, or Value at Risk is another one of many concepts in finance that sounds much more intimidating to some…

Risk adjusted returns of investments and variance analysis used in corporate finance and accounting will both depend on understanding some…

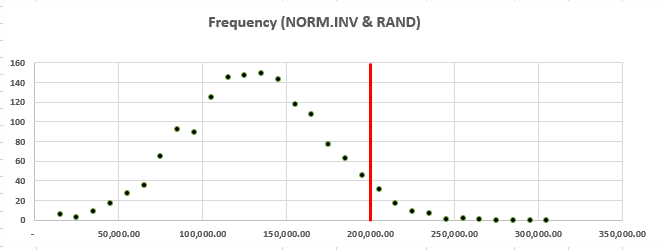

Arguably the simplest approach towards generating normal distributions using pseudo-random numbers is through a combination of RAND and Norm.S.Inv. Norm.S.Inv…